Here’s why you can’t afford Measure I – your taxes keep going up, your utility bills, groceries, gas prices too. Yet your income is stagnating, or worse, declining.

Late last month, Bloomberg Businessweek covered a report by the Economic Policy Institute that confirms what you already know – you’re pedaling faster and faster, but not getting anywhere.

Real hourly wages declined for almost every segment of the U.S. workforce in the first half of 2014, according to a briefing paper released Wednesday morning by the Economic Policy Institute, a liberal think tank. “The last year has been a poor one for American workers’ wages,” economist Elise Gould, who directs EPI’s health policy research, writes in the report.

As this chart shows, unless you are at the very top of the pile in terms of income, your real wages – ‘real’ means as measured after inflation – have stayed flat or even declined since 2010.

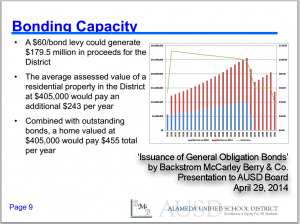

And yet, the school district wants to double what you pay now for school bonds, as shown in the chart below, provided by the bond consultant to the school district. And that’s on top of the parcel tax!

Presentation by bond consultants show that under Measure I, tax bond payments would effectively double, and this is in addition to the parcel tax from 2011.

You can’t afford Measure I – your real income is declining, and yet the school district keeps coming back for more and more.

Vote No on I